By Tom Mullaney

The biggest overhaul since Medicare nearly 50 years ago will soon be upon us.

Come January 1, the Affordable Care Act (ACA) adds an additional 29 million uninsured people and upwards of 17 million Medicaid recipients to America’s healthcare rolls. By 2015, employers with more than 50 full-time employees must provide them with health coverage.

Almost everything about this momentous change is fraught with uncertainty. Funds for implementation are mired in political gridlock, regulations are still being drafted, half the states have refused to expand Medicaid coverage, and the number of young and healthy citizens who will opt out is cloaked in mystery.

Stephen Jenkins, who directs the Center for Strategic Planning at SG2, Skokie-based health information consultants, confirms the confusion. “There’s a bumpy road ahead in the next six months that will continue well into 2014. Many employers and individual payers will wait out the first year and see how it plays out before enrolling in 2015.”

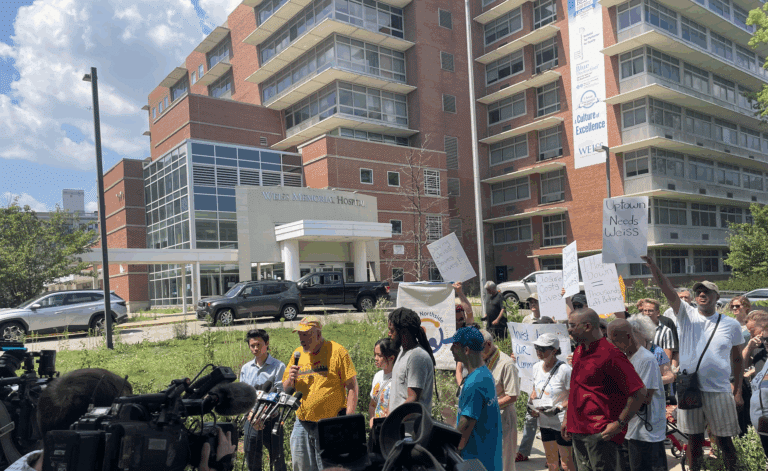

Many health providers remain stuck, unsure how soon the transformation will occur, what it will look like and how fast to act. This may explain the reluctance of hospital executives at Loyola, Northwestern, Rush and NorthShore to be interviewed about changes they intend to implement.

American medicine is flipping from a volume-driven, episodic enterprise—more tests, repeat visits, hospital admissions—to more managed, evidence-based care. The ACA’s keystone goal moves away from fee-for-service (FFS) reimbursements to a population health model that drives medical delivery and financial incentives down the chain to primary care physicians. It aims to substitute acute care in hospital emergency rooms with patient-centered medical homes, primarily in doctors’ offices.

A survey of 823 healthcare leaders, according to Truven Health Analytics, found that 92 percent of these leaders named reduced reimbursements their greatest threat. Besides drops in FFS payments, hospitals are busy redesigning practices to lower readmissions. Hospitals whose patients are readmitted within 30 days of discharge incur substantial penalties.

Dr. Chad Whelan, associate chief medical officer and a leader of the transition team at University of Chicago Medicine (U of C), identifies seven high-cost populations that the medical center will focus on over the next two years in a cost-containment push: pediatric asthma, heart attacks and heart failure, nursing homes to hospital-care transitioning and highest medical utilizers. In 2014, populations with chronic obstructive pulmonary disease, pneumonia, total hip and knee replacements will be added. Meanwhile, its new hospital, which opened last fall, will handle more intensive cases and perform previously impossible hi-tech surgical procedures—generators of increased revenue.

San Diego-based Scripps Health’s CEO Chris Van Gorder claims that, “Over the next 5–10 years, hospital systems will be living in a hybrid environment…” And according to Whelan, that model hampers health executives’ planning. “We don’t have a clear story to tell people since there are two models. Part is changing and part has not changed,” Whelan says.

That dilemma of how fast to drive change is the biggest issue facing many healthcare executives, says Jenkins. Go too fast and suffer revenue deterioration; go too slow and lose out to nimbler competition.

Locally, Advocate Health Care, DuPage Medical Group (DMG) and Presence Health are change drivers. “We’re jumping in with both feet. We’re definitely not wait-and-see,” says Dr. Barbara Loeb, Presence Health’s vice president of primary care services and chief medical officer.

Advocate has 40 percent of current holdings in risk-based contracts. Lee Sacks, CEO of Advocate Physician Partners, expects it to be 70 percent by 2015.

Sacks thinks that the tipping point will arrive quickly—two to four years—and will catch many by surprise. “Those who stay in the old paradigm and are unable to change [are most at risk].They should be asking themselves, ‘What do I need to do to make sure I’m not irrelevant?’”

Winning Hospital Strategies

Hospitals aren’t necessarily losers in the new landscape’s price flip.

The addition of more than 40 million potential new patients and coverage for current charity cases can slash costs and inject new revenue. Even as healthcare moves more delivery into physician offices, nearly 90 percent of 282 senior leaders in a 2013 HealthLeaders Media survey, expect their emergency department volumes to increase over the next three years. The reason: a shortage of primary care physicians, impeding patient access.

Another strategy that hospitals are adopting is acquisition of both the hospital and physician practices. With one stroke, such measures expand patient populations, close the critical hospital and physician loop and add market share. “Unless you grow market share, it will take out revenue,” says Sacks. (Sherman Health Systems merged with Advocate in June.)

Conducting a population health profile in a hospital’s community is a critical requirement for better delivery outcomes and major cost savings. Loeb told a recent industry audience, “Unless we customize the needs of the community we serve, we [could] go bankrupt implementing the wrong assessment.”

It is widely agreed that electronic medical records and community health profiles will enable major investment upgrades. “Hospitals will need an enterprise view of clinical performance and population risk to navigate the transition successfully,” says Larry Yuhasz, director of strategy at Truven Health. This means unifying payer data—now broad and shallow—with narrow and deeper clinical data.

Accountable Care Organizations (ACO), a new Medicare pay-for-performance tool, can drive future revenue growth. There are reportedly 250 current ACOs nationwide. The Chicago area has been slow to embrace them. While 30 percent of health systems nationwide have managed care programs, Illinois’ acceptance is only 15 percent. Sacks thinks that number will rise going forward. Advocate recently partnered with Blue Cross/Blue Shield of Illinois to establish the first local ACO.

L. Rita Fritz, president of Systems, Inc., sees danger in the race to lower cost and upgrade care. “While hospital legacy operations are driving healthy cash flow now, those operations will become an albatross in the era of patient care management.” Traditional legacy expense-reduction strategies create “high, even fatal, risks” when competing on cost and clinical quality, she says. “The ops to support the new health world must be built from a clean slate, starting at the point of patient care and working backwards.”

Into the Clearing

While media coverage has dwelled on the price flip from costly services to value-based health, a less-examined flip merits attention: shifting power dynamics among current players. “Power dynamics” is not used in a zero-sum sense. Up to now, the money-making influencers have been hospitals and insurance companies. Once the ACA model is fully implemented, physicians and patients will also take their place at the table, having more influence in the new medical paradigm. Hospitals’ first-player position will give way to a more collaborative, multiplayer management model.

Four developments are driving such an outcome. First, physicians’ gains as collaborative care partners will lead to a stronger, shared leadership role in hospital governance (including board representation) and operations.

Second, the ACA will incentivize physician groups to consolidate their practices, achieving stronger clinical integration and bargaining strength. Locally, DMG, with almost 400 staff physicians, has entered into joint ventures with Edward Health and Humana. DMG also acquired M&M Orthopedics.

Third, greater price transparency will rein in billing outliers and empower consumers to make more informed decisions. Loeb says she was billed a “ridiculous” $400,000 for what she claims should have been a $40,000 surgical procedure.

Finally, ACA pushes preventive care and more self-care patient engagement in their treatments. Along with greater responsibility, patients will exercise more control over future treatment options, a crucial pivot point in transitioning to a value-driven system.

“What is it we really sell?” asks Van Gorder. “We sell relationships [between healthcare providers and patients]. And yet, we haven’t cared much about [those] relationships. For the first time ever, we’re actually going to have to build a relationship with our patients and then find out what their needs are.”

Medicine’s brave new world is emerging. Once healthcare’s puzzling transition period passes, America may find it has stumbled upon a much improved system, better in terms of cost, patient coverage and delivery of quality care.

Published in Chicago Health Summer/Fall 2013