Why you should start considering it now

By Morgan Lord

The fact is, you’re getting older every day. And as long as that keeps happening, you’re going to live longer.

According to the U.S. Department of Health and Human Services (HHS), 70 percent of people turning 65 years old can expect to use some form of long-term care during their lives—think home health services, assisted living or nursing homes. So why aren’t more people talking about it? Because it’s a morbid thought? We’re not talking about death here—we’re talking about your quality of life.

When you need help with two or more of your activities of daily living, which includes bathing, dressing, eating, using the toilet, relocating from a bed to a chair or caring for incontinence, your policy benefits will kick in. Cognitive impairment, such as dementia or Alzheimer’s, is another way for benefits to be activated.

Unlike traditional health insurance, long-term care insurance typically covers long-term services including personal and custodial care (dressing, bathing, help with grocery shopping, caring for pets, housework, administering medication, etc.), and skilled nursing care, occupational, physical and rehabilitation therapy. And despite what many people think, your long-term care insurance doesn’t limit you to getting care in a nursing home. With long-term care insurance, you can use your daily benefit however you choose, whether in your home or in an external facility.

“Having long-term care insurance gives you the freedom of choice when it’s time to seek care,” says Susan Zimmerman, RN, care manager and licensed independent insurance agent specializing in long-term care insurance (with Genworth, Mutual of Omaha and Bankers Life and Casualty, among others). “You can stay in your home and receive quality care, and you have much more flexibility.”

If you’re banking on Medicare and Medicaid to pick up the bill, bank no more. Medicare covers up to 100 days of long-term care after you’ve been in the hospital for three days prior to needing the services.

“This is a worst-case scenario for an urgent situation, not ongoing care,” says Kevin Heraty, chief marketing and development officer for Cantata Adult Life Services in Brookfield.

Medicaid is only available after you’ve drained all of your accounts—your retirement fund, your savings, every last penny—and you’re limited in the places you can get care, and thus limited in your quality of care.

“What if one of us is diagnosed with a chronic illness? The other person has to be the caregiver. This plan is looking out for both of us.”

“In a way, this is a middle-class problem,” Zimmerman said. “Those who are financially struggling have to depend on Medicaid, and those who are rich can afford to pay out of pocket when the time for care comes. That leaves the middle class in a predicament, and our best bet is to insure ourselves.

Here’s a scary statistic: Fewer than one-third of Americans over 50 have begun saving for long-term care. And costs, on average, range from $4,000 to $8,000 per month, according to the HHS.

“So many people do not realize the cost of care in later life, and it’s only getting more costly,” Heraty says. “To me, I look at it as protecting my wife and [me] against the catastrophic—a chronic condition that can last for a long time,” Heraty says. “What if one of us is diagnosed with a chronic illness? The other person has to be the caregiver. This plan is looking out for both of us.”

When Jeff Emrich, president of BrightStar North Suburban, a skilled and nonmedical in-home care company in Northbrook, got into the business of homecare, he saw families spending $4,000 a month for years for one family member’s care. “That can add up [to half] a million dollars very easily,” Emrich says.

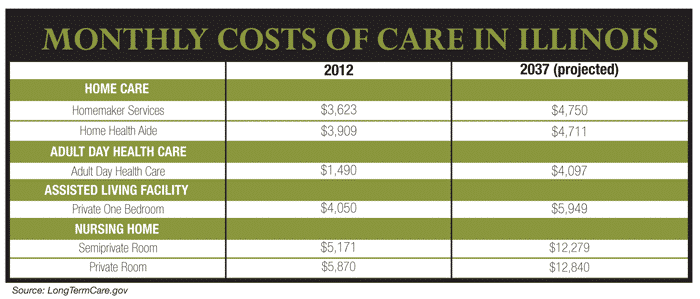

In Illinois, the costs of long-term care services are increasing daily, according to LongTermCare.gov. In 2012, the cost of a year with a home health aide, a nurse who comes to the home to provide necessary services, was about $47,000 a year. In 2037, the yearly rate for a home health aide is projected to inflate to $57,000. Likewise, a private one-bedroom at an assisted living facility in 2012 cost $49,000 and is projected to grow to $71,000 by 2037. A private room in a nursing home would likewise increase from $70,000 to $154,000 between 2012 and 2037.

If you were to take out an insurance plan in your late 40s or early 50s, you would only have to pay a few hundred bucks a month for both you and your spouse, Heraty says.

According to the HHS, you can select a range of care options and benefits that allow you to get the services you need, where you need them. The cost of your policy is based on the following: how old you are when you purchase it; the daily maximum amount; the number of years the policy will pay; and any additional benefits you choose.

When shopping for long-term care insurance plans, it is important to do your research, says Zimmerman. Research the insurance company’s track record for premium increases; find out your range of long-term care options; ask whether there is a death benefit, evaluate the rating of the insurance company through one of the independent rating companies (A.M. Best; Standard and Poor’s; Moody’s); and look into tax-qualified options.

A good starting place is paging through the Illinois Department of Insurance shopper’s guide.

“What we see most often is adult children seeking care for their elderly parents,” says Emrich. “If their parents don’t have long-term care insurance, before the end of our meeting, I almost always hear the kids say, ‘We’re not going to be in their situation—we’re researching a long-term plan as soon as we leave.’”

Published in Chicago Health Winter/Spring 2014